ICON Advisers Wins Multiple 2021 Lipper Awards

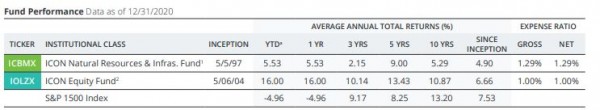

DENVER – March 15, 2021 – ICON Advisers, Inc., sub-adviser to the ICON Funds, announced that the ICON Natural Resources & Infrastructure Fund (ICBMX) and the ICON Equity Fund (IOLZX) were recognized this morning by Refinitiv as 2021 Lipper Fund Award winners. The Lipper Fund Awards from Refinitiv have honoured funds and fund management firms that have excelled in providing consistently strong risk-adjusted three-, five-, and ten-year performance relative to their peers, based on Lipper’s proprietary performance-based methodology. The ICON Natural Resources Fund, Institutional Class has won the award for the three-year, five-year, and ten-year periods, which ended 11/30/2020. The ICON Equity fund has won the award for the ten-year period which also ended 11/30/20.

“This year’s Refinitiv Lipper Fund Awards recognized the steadfast resolve of award-winning managers and firms who successfully navigated one of the sharpest market downturns and recoveries on record enabling investors to maintain a level of economic confidence amidst a backdrop of uncertainty. We congratulate the 2021 Refinitiv Lipper Fund Award winners and wish ICON Advisers, Inc. continued success.”

Robert Jenkins, Head of Research, Lipper, Refinitiv

The ICON Natural Resources & Infrastructure Fund (ICBMX – Insitutional Class) seeks long-term capital appreciation while the ICON Equity Fund (IOLZX – Institutional Class) seeks capital appreciation, along with capital preservation, in the attempt to provide long-term growth, both using ICON’s proprietary and quantitative methodology to identify securities which we believe are underpriced relative to their intrinsic value.

• The ICON Natural Resources & Infrastructure Fund normally invests across all market capitalizations in equity securities of companies with operations that own, explore or develop natural resources and other basic commodities, or supply goods and services to such companies, within the Energy, Industrials, and

Materials GICS Sectors.

• The ICON Equity Fund is a diversified fund that invests at least 80% of it net assets, plus any borrowing for investment purposes, in a variety of asset classes, including equity securities, for companies of any market capitalization.

About ICON Advisers, Inc.

ICON Advisers, Inc. is a boutique firm based in Greenwood Village, Colorado. Since its inception, ICON has employed a unique and disciplined investment approach to the way we manage assets. In 1986, Dr. Craig Callahan founded ICON using a modernized Benjamin Graham valuation model to systematically determine the intrinsic value of individual companies in order to make clear, objective investment decisions. Today, ICON offers a diverse lineup of mutual funds, Tactical Allocation Portfolios, and Strategy Based Investing Portfolios providing a wide spectrum of investment options. With our broad scope and commitment to uncovering value, our Funds and Portfolios can accommodate a wide range of investment needs.

a) Not annualized. The data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the data quoted. Please call 1-800-828-4881 or visit www.InvestwithICON.com for performance results current to the most recent month end. Returns assume the reinvestment of dividends and capital gain distributions and reflect applicable fees and expenses. Performance without maximum sales charge does not include front-end or contingent deferred sales charges. Performance is for the Fund’s Institutional Class shares. Performance for the Fund’s other share classes will vary due to differences in charges and expenses.

Opinions and forecasts regarding sectors, industries, companies, countries and/or themes, and portfolio composition and holdings, are all subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security, industry, or sector.

Shelton Capital Management has contractually agreed to reimburse expenses incurred by the Fund to the extent that total annual fund operating expenses (excluding acquired fund fees and expenses, certain compliance costs, and extraordinary expenses such as litigation or merger and reorganization expenses, for example) exceed 1.50% for the ICON Natural Resources Funds, Institutional Class shares until May 20, 2021. Shelton Capital Management has contractually agreed to reimburse expenses incurred by the Fund to the extent that total annual fund operating expenses (excluding acquired fund fees and expenses, certain compliance costs, and extraordinary expenses such as litigation or merger and reorganization expenses, for example) exceed 1.25% for the ICON Equity Fund, Institutional Class, until May 20, 2021. Thess agreements may only be terminated with the approval of the SCM Trust Board. Shelton may be reimbursed for any foregone advisory fees or unreimbursed expenses within three fiscal years following a particular reduction or expense, but only to the extent the reimbursement does not cause the Fund to exceed applicable expense limits, and the effect of the reimbursement is measured after all ordinary operating expenses are calculated. Any such reimbursement is subject to the review and approval of the SCM Trust Board.

1) The ICON Natural Resources and Infrastructure Fund of SCM Trust is the successor fund to three funds of ICON Funds trust, the ICON Energy Fund, the ICON Industrials Fund, and the ICON Natural Resources Fund (the “Predecessor Funds”). The Predecessor Funds were reorganized into a new series of SCM Trust as the ICON Natural Resources and Infrastructure Fund after the close of business on July 10, 2020. All historic performance and financial information presented is that of the predecessor ICON Natural Resources Fund which was the accounting and performance survivor of the reorganizations.

2) The ICON Equity Fund of SCM Trust is the successor fund to three funds of ICON Funds trust, the ICON Fund, the ICON Long/Short Fund, and the ICON Opportunities Fund (the “Predecessor Funds”). The Predecessor Funds were reorganized into a new series of SCM Trust as the ICON Equity Fund after the close of business on July 10, 2020. All historic performance and financial information presented is that of the predecessor ICON Long/Short Fund, which was the accounting and performance survivor of the reorganizations.

The Refinitiv Lipper Fund Awards, granted annually, highlight funds and fund companies that have excelled in delivering consistently strong risk-adjusted performance relative to their peers.

The Refinitiv Lipper Fund Awards are based on the Lipper Leader for Consistent Return rating, which is a risk-adjusted performance measure calculated over 36, 60 and 120 months. The fund with the highest Lipper Leader for Consistent Return (Effective Return) value in each eligible classification wins the Refinitiv Lipper Fund Award. For more information, see lipperfundawards.com Although Refinitiv Lipper makes reasonable efforts to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Refinitiv Lipper.

The awards for the ICON Natural Resources Fund are for the Fund’s Class S shares. Performance for the Fund’s other share classes will vary due to differences in charges and expenses. A Lipper Certificate does not ensure positive fund performance. LIPPER and the LIPPER Corporate Marks are proprietary trademarks of Lipper, a Reuters Company.

ICON Advisers, Inc. is the subadviser to the ICON Funds. RFS Partners is the distributor of the ICON Funds.

Consider the investment objectives, risks, charges, expenses, and share classes of each ICON Fund carefully before investing. The prospectus and the statement of additional information contain this and other information about the Funds and are available by visiting www.ICONAdvisers.com or calling 1-800-828-4881. Please read the prospectus and the statement of additional information carefully before investing.

Media Contact

Company Name: ICON Advisers, Inc.

Contact Person: Brian Rotter

Email: Send Email

Phone: 3037901600

City: Greenwood Village

Country: United States

Website: www.ICONAdvisers.com